Buying, Selling and Leasing

Step 1. Start with the Application Form below.

Step 2. Complete the Realtor Form for the appropriate lake, and submit it to the email address indicated within the form.

Please note:

We cannot accept scanned legal documents or electronic signatures via email. You must sign original legal documents from Georgia Power and have them notarized and witnessed in order to validate document. These legal documents are recorded at the county courthouse where the property is located.

Understanding Lots and Restrictions

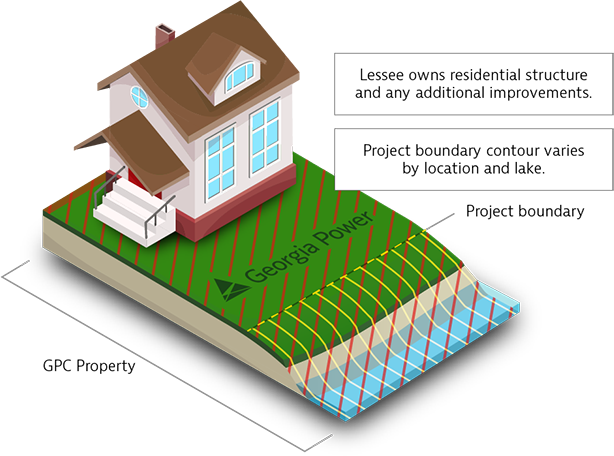

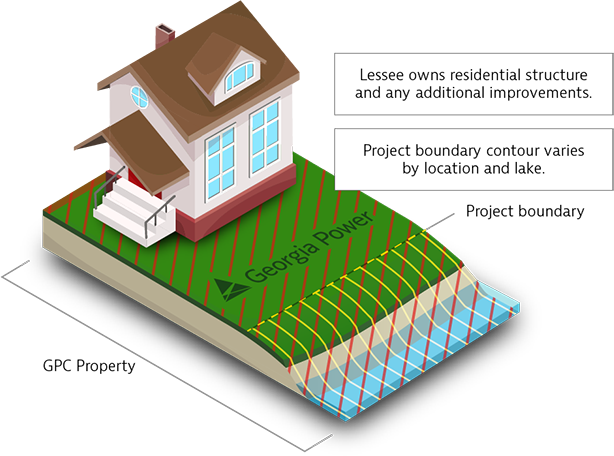

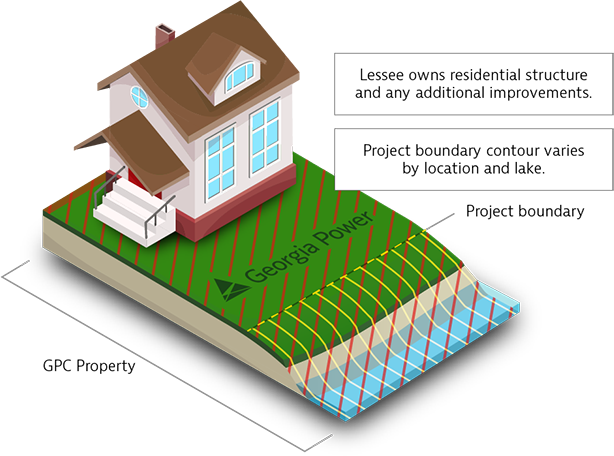

Residential Lease Lot

Georgia Power owns the land/lot and lessee owns any improvements (dwelling, shoreline structures). An annual fee applies.

Selling a home on a Georgia Power Lease Lot

- Notify your Georgia Power Lake Resources office about your listing. The Georgia Power shoreline management representative for your county/lake will complete a pre-transfer inspection to confirm what, if any, compliance issues exist. This information could be important as part of the Seller’s disclosure process.

Purchasing a home on a Georgia Power Lease Lot

- Contact appropriate Georgia Power lake office as soon as you are under contract to begin the process of transferring the lease. The transfer of lease is required to take place in conjunction with your closing. Please allow three to four weeks for lease transfer. A new as-built survey may be required to transfer lease.

Early Renewal of Georgia Power Lease

- Contact appropriate Georgia Power lake office to begin early renewal process. There is a $250 fee for an early renewal required at the time the new lease is signed. Please allow three to four weeks for an early lease renewal. A new as-built survey may be required at time of early renewal.

Transfer of Lease to an Entity (Ex: LLC, Trust, etc.)

- Contact appropriate Georgia Power lake office for transfer documents. There is a $500 fee to transfer the lease into an entity that is required at the time the new lease is signed. A new as-built survey may be required at time of transfer.

Survey Requirements

Residential Lease Lot – Survey Requirements

In instances where properties have an outdated or incomplete survey, a new survey may be required at renewal or transfer of lease lot to a new owner.

Complete surveys should show the following information:

- All improvements located on the lot and the dimensions of those improvements (dwelling, detached garages, etc.). If additions have been made to the dwelling, these additions should be included on a revised survey.

- Shoreline structures on lot and dimensions along with setback from side lot lines.

- Project Boundary Contour Elevation for the specific lake the property resides on.

- Closet point of the dwelling to the lake. For existing residential dwellings that are less than 50′ from the shoreline, typically these structures must remain “as is.”

Tax Explanation

Georgia Power Lease Lot Tax Recovery Program – Alabama

- Georgia Power leases non-utility property for construction of single family residences or cottages for general recreational purposes.

- Paragraph 25 of the Georgia Power lease provides for the tax on the lease lot to be billed to the lessee.

- Georgia power started billing the “Tax Assessment” in June 2001.

- The Lee County Chief Appraiser’s office establishes the lake lot property values on Georgia Power lease lots.

- The annual property tax assessment for each lot is calculated by multiplying the lot value times the Alabama statutory utility assessment ratio of 30% times the county millage rate for that year.

- Georgia Power’s goal is to ensure individual lots are valued at or below the market to ensure taxes are appropriate. Georgia Power reviews changes in the real estate market around the lake annually with the county tax assessors and local appraisers.

- Georgia Power does not benefit or profit from the tax assessment program, this is a pass through of costs incurred.

- Georgia Power pays the tax cost for the current year and takes a tax deduction in the same year. The following year Georgia Power bills the lessee and treats the lessee’s payment as revenue and pays income tax on the revenue.

- There is no income tax deduction available to lessee’s because Georgia Power is the land owner paying the taxes.

- The Federal Energy Regulatory Commission (FERC) is aware of the company’s leasing program and activities involving the tax billing. FERC has no jurisdiction over the company’s leasing program of non-utility property. Also, the leasing programs is not regulated by the Georgia Public Service Commission.

Georgia Power Lease Lot Tax Recovery Program – Georgia

- Georgia Power leases non-utility property for construction of single family residences or cottages for general recreational purposes.

- Paragraph 25 of the Georgia Power lease provides for the tax on the lease lot to be billed to the lessee.

- Georgia Power started billing the “Tax Assessment” in June 2001.

- The Department of Revenue (DOR) establishes the lake lot property values on Georgia Power lease lots; not the counties.

- The annual property tax assessment for each lot is calculated by multiplying the lot value times the Georgia statutory assessment ration of 40%, times the county millage rate for that year. In some years the assessment ratio that is applied to the lot value can be less than 40%. This occurs when statistical studies performed by the State Auditor show that the average assessed value of locally assessed property in the county is below 95% of fair market value. If so, taxes on Georgia Power lake lots will be “equalized” with locally assess property by reducing the 40% assessment ratio by the appropriate amount, e.g., 92.5% average FMV = 37% equalization ratio.

- Georgia Power’s goal is to ensure individual lots are valued by the DOR at or below the market to ensure taxes are appropriate. Georgia Power reviews changes in the real estate market around the lake annually with the county tax assessors and local appraisers then works with the DOR to make adjustments to values.

- Georgia Power does not benefit or profit from the tax assessment program, this is a pass through of costs incurred.

- Georgia Power pays the tax cost for the current year and takes a tax deduction in the same year. The following year Georgia Power bills the lessee and treats the lessee’s payment as revenue and pays income tax on the revenue.

- There is no income tax deduction available to lessees because Georgia Power is the land owner paying the taxes.

- The Federal Energy Regulatory Commission (FERC) is aware of the company’s leasing program and activities involving the tax billing. FERC has no jurisdiction over the company’s leasing program of non-utility property. Also, the leasing program is not regulated by the Georgia Public Service Commission.