get social security if you never worked" />

get social security if you never worked" /> get social security if you never worked" />

get social security if you never worked" />

It may seem logical that if you never worked — and therefore never paid into Social Security — that you would not be eligible to receive Social Security benefits. Well, that’s not the case. In fact, there are several different scenarios in which a person can receive Social Security benefits without ever having paid into the system, or even worked, for that matter.

Among the people eligible for Social Security without having worked are spouses and former spouses of people who are eligible for benefits, and survivors of beneficiaries along with their qualified children.

Retirement is 99% easier when your paperwork is organized. Join 250,000+ Americans securely storing their important receipts, bills & documents with the SimplyWise app.

Get the AppLet’s start with retirement benefits and how a spouse or ex-spouse who has never worked can qualify for them. To claim Social Security spousal benefits, you’ll need to meet certain criteria, including being at least age 62 in most cases. Your spouse or ex-spouse also must be living. Keep in mind that the criteria for spousal benefits varies depending on whether you’re married or divorced.

If you’re married, your spouse must already be collecting his or her Social Security benefits in order for you to claim spousal benefits.

If you’re divorced, your benefits aren’t connected, so you can claim spousal benefits even if your ex isn’t collecting Social Security yet and you do not need the consent of your ex-spouse. Both of you, however, must be at least age 62. If you’ve been divorced more than once, your benefit can be based on your highest-earning spouse if that marriage meets the qualifications.

To qualify for spousal benefits you must:

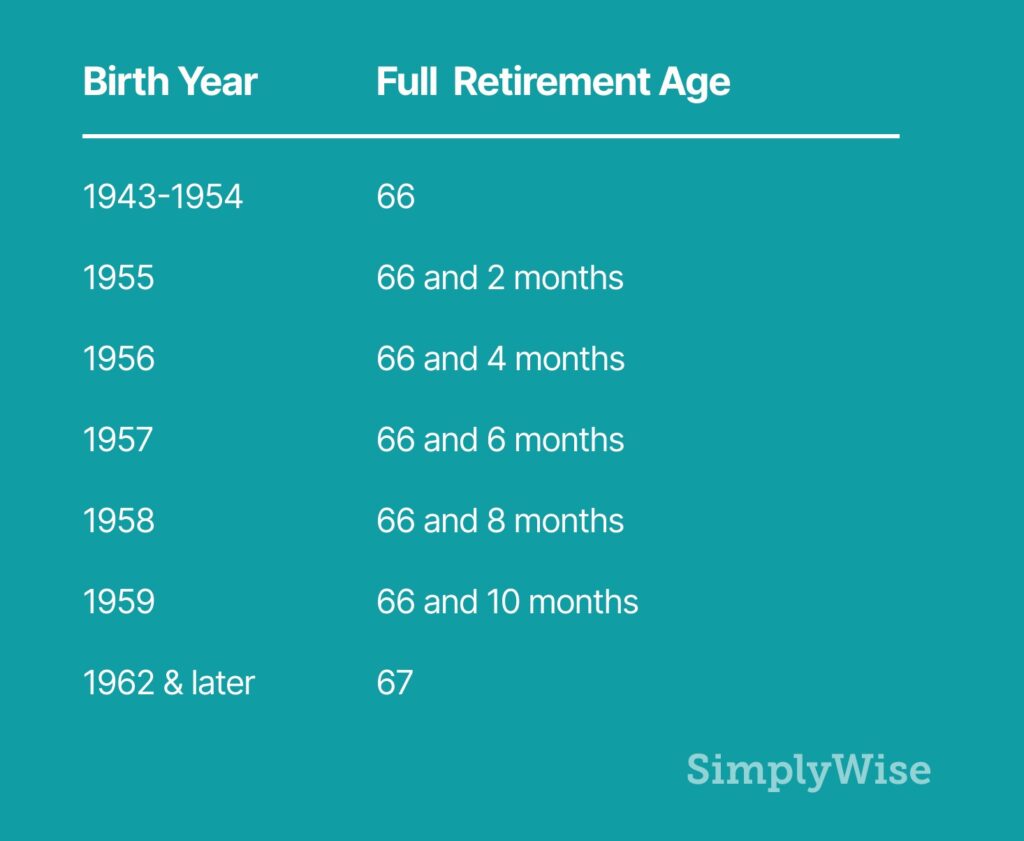

There are many variables regarding how and when you can apply for a spousal benefit, but one of the most important things to keep in mind is that spousal benefits are reduced for each month before your full retirement age that you begin receiving benefits. Your full retirement age is based on your birth year:

So if you claim at age 62, your earliest opportunity, you could receive as little as 32.5% of your spouse’s primary insurance amount, or PIA. That permanently reduces your spousal benefits. If your spouse also took his or her Social Security benefits early, your survivor benefits (those you can claim if your spouse dies) also will be permanently reduced.

When you reach full retirement age, you are eligible for 50% of your spouse’s PIA. The Social Security Administration offers a calculator to figure out the size of your spousal benefits depending on when you claim them.

Also keep in mind that spousal benefits don’t grow after full retirement age. Unlike earned benefits, which grow 8% every year between your full retirement age and age 70, your spousal benefit does not increase once you’ve reached full retirement age.

Social Security Disability Insurance (SSDI) benefits are for people who are eligible for Social Security retirement benefits, but became disabled before they reached full retirement age. When a beneficiary begins to receive disability benefits, certain members of their family may also qualify for benefits, including:

Keep in mind that any family members who may apply for these benefits will need to provide a Social Security number and possibly their birth certificate in order to prove their qualification.

According to the Social Security Administration website, “each family member may be eligible for a monthly benefit of up to 50 percent of your disability benefit amount. However, there is a limit to the amount we can pay your family.

“The total depends on your benefit amount and the number of family members who also qualify on your record. The total varies, but generally the total amount you and your family can receive is between 150 and 180 percent of your disability benefit.

“If the sum of the benefits payable on your account is greater than the family limit, the benefits to the family members will be reduced proportionately. Your benefit will not be affected.”

Social Security survivors benefits are available to spouses, ex-spouses, children and dependent parents of someone who worked and paid into the Social Security system. The amount of the benefits depends on the beneficiary’s age and relationship to the worker, as well as the lifetime earnings of the worker who died. The more the deceased worker earned, the higher the benefits will be.