Do you know how to apply forex risk management so your losses feel like an “ant bite” to your account?

Do you have the ability to trade any markets or timeframes, and not blow up your trading account?

Do you know the secret to finding low-risk high reward trades?

If you answered NO to any of the above…

Then good luck to you.

Today’s post is going to be one of the most important you’ll ever read. Because if you apply the forex risk management and position sizing strategies, I can guarantee you’ll never blow up another trading account — and you might even become a profitable trader.

And to prove my point, here’s what you’ll learn today:

Are you ready? Then let’s begin…

Risk management is the ability to contain your losses so you don’t lose your entire capital. It’s a technique that applies to anything involving probabilities like Poker, Blackjack, Horse betting, Sports betting and etc.

Here’s the thing:

If you have a $10,000 trading account, would you risk $5000 on each trade?

Because it only takes 2 losses in a row and you’ll lose everything. And even a profitable trading strategy won’t save you.

Don’t believe me? Then let me prove it to you…

Imagine:

There are two traders, John and Sally.

John is an aggressive trader and he risks 25% of his account on each trade.

Sally is a conservative trader and she risks 1% of her account on each trade.

Both adopt a trading strategy that wins 50% of the time with an average of 1:2 risk to reward.

Over the next 8 trades, the outcomes are Lose Lose Lose Lose Lose Win Win Win Win.

Here’s the outcome for John:

-25% -25% – 25% – 25% = BLOW UP

Here’s the outcome for Sally:

-1% -1% -1% -1% +2% +2% +2% +2% = +4%

Can you see how powerful this is?

Clearly, you should never risk too much per trade and definitely never go all-in on a single trade.

To further manage your risk, you can avoid trading during major economic events.

This way, you’ll avoid the volatility spikes that will easily whip you out of your trades.

The price pattern will also be clearer when there are no major economic events.

Risk management could be a deciding factor on whether you’re a consistently profitable trader or, losing trader.

Remember, you can have the best trading strategy in the world. But without proper risk management, you will still blow up your trading account. It’s not a question of if, but when.

Now you’re probably wondering:

“How do I apply proper risk management?”

Position sizing.

A technique that determines how many units you should trade to achieve your desired level of risk. And this is the closest thing you can get to the “holy grail”.

But before you calculate your position size, you must know these 3 things:

Value per pip is the change to your P&L if the price moves by 1 pip. To calculate this, you need three things: The currency of your trading account, the currency pair traded, and the number of units traded.

Your trading account is in SGD.

You’re trading EUR/USD.

You long 100,000 units of it.

If EUR/USD increases by 1 pip, what is the impact on your P&L (in SGD)?

Step 1: Determine the value per pip of the currency pair you’re trading

Since you’re trading EUR/USD…

The EUR is the base currency and the USD is the quote currency.

To determine the value per pip, look at the quote currency.

If you’re long 100,000 units of EUR/USD, the value per pip is $10USD.

Step 2: Determine the spot rate between the currency of your trading account and the quote currency

The currency of your trading account is in SGD.

Thus, look at the spot rate of USD/SGD.

Step 3: Multiply the spot rate with the value per pip of the currency you’re trading

Let’s assume the spot rate of USD/SGD = 1.30

1.30 * 10 = 13 SGD

This means every 1 pip movement in EUR/USD is worth $13USD to you.

Now to make your life easier, you can use this FREE pip value calculator that I’ve created for you.

It’s a Forex lot size calculator that automatically takes into account your current balance and currency to manage risk more efficiently.

Your trading account is in USD and you long 500,000 units of EUR/GBP.

If EUR/GBP moves by 1 pip, what is the impact on your P&L (in USD)?

Step 1: Determine the value per pip of the currency pair you’re trading

Since you’re trading EUR/GBP…

The EUR is the base currency and the GBP is the quote currency.

To determine the value per pip, look at the quote currency.

If you’re long 500,000 units of EUR/GBP, the value per pip is $50GBP.

Step 2: Determine the spot rate between the currency of your trading account and the quote currency

The currency of your trading account is in USD.

Thus, look at the spot rate of GBP/USD.

Step 3: Multiply the spot rate with the value per pip of the currency you’re trading

Let’s assume the spot rate of GBP/USD = 1.25

1.25 * 50 = 62.5USD

This means every 1 pip movement in EUR/GBP is worth $62.5USD to you.

Now to make your life easier, you can use a pip value forex risk calculator like this one from Investing.com.

This means how much you’re risking on each trade (in terms of dollar value).

I suggest risking not more than 1% of your account per trade. Why?

Because you don’t want a few losses to put you in a steep drawdown, or wipe out your trading account. And not forgetting, you need proper risk management to survive long enough for your edge to play out.

Here’s how to calculate your dollar risk per trade:

Let’s assume you have a $10,000 account.

You’re risking 1% of your capital on each trade.

Here’s the math: 1% of $10,000 = $100

This means you’ll not lose more than $100 per trade.

Remember, the risk of ruin is not linear. This means the more money you lose, the harder it is to recover back your losses.

The final ingredient is finding out what is the size of your stop loss (in terms of pips, or ticks if you’re trading stocks and futures).

I’m not going into full detail on how to set your stop loss. But the way I do it is by placing my stop loss at a level where if it’s reached, it will invalidate my trading idea. If you want to learn more, go watch the video below:

If you ask me, risk management and position sizing are two sides of the same coin. You can’t apply risk management without proper position sizing.

You’ll learn how to calculate your position size for every trade, so you will never blow up another trading account. Let’s go!

So, the question is…

“How many units do you short so you only risk 1% of your trading account?”

Here’s the formula:

Position size = Amount you’re risking / (stop loss * value per pip)

Plug and play the numbers into the formula and you get:

Position size = 100 / (200*10)

= 0.05 lot (or 5 micro lots)

This means you can trade 5 micro lots on GBP/USD with a stop loss of 200 pips; the maximum loss on this trade is $100 (which is 1% of your trading account).

Now you’re probably wondering:

“Rayner, this is so cumbersome. Is there a faster way to calculate it?”

All you need to do is use a forex position sizing calculator and I’ll explain more in this video…

However, just keep in mind that you can easily make a forex risk calculator on your excel spreadsheet by using the formulas mentioned above!

Once you understand how position sizing works, you can apply it across all markets. This means you can manage your risk like a pro no matter what instruments you’re trading.

Here’s an example for stock:

How many shares of Mcdonalds do you buy so you risk only 1% of your trading account?

Here’s the formula:

Position size = Amount you’re risking / (stop loss * value per tick)

Insert these numbers into the formula and you get:

Position size = 500 / (250*0.01)

= 200 shares

This means you can trade 200 shares of Mcdonalds with a stop loss of 250 ticks. If it’s triggered, the loss on this trade is $500 (which is 1% of your trading account).

Remember, when you’re trading stocks, the price can gap through your stop loss — causing you to lose more than you intended. This is a common occurrence during earnings season.

I know this is a slow way to calculate your position size for stocks. That’s why you can use a position sizing calculator to make your life easier, which I’ll explain more in this video…

To make your life easier, you can use one of these forex risk management calculator below:

MyFxBook – Position sizing calculator for forex traders.

Daniels Trading – Position sizing calculator for futures traders.

Investment U – Position sizing calculator for stock and options traders.

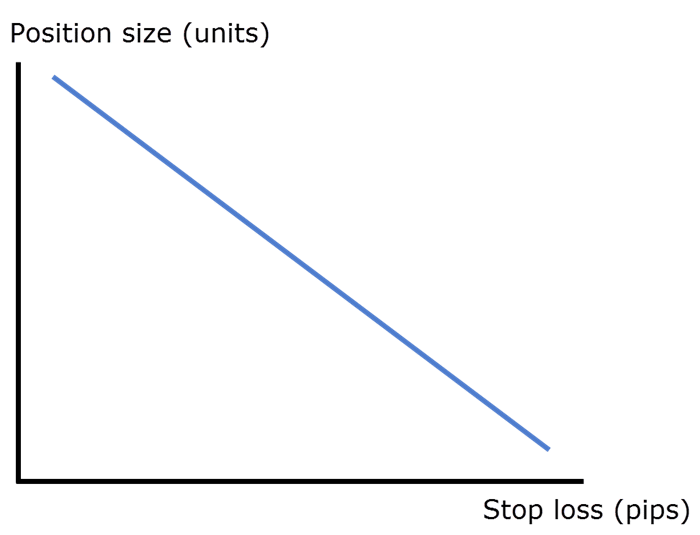

The larger the size of your stop loss, the smaller your position size (and vice versa).

Visually, it looks like this:

Now, let me prove it to you…

So, how many units can you short?

Position size = 1000 / (500 * 10)

= 0.2 lot (or 2 mini lots)

For this trade, if the market moves 500 pips in your favor, you’ll gain $1000.

But what if you can reduce your stop loss to 200 pips?

Position size = 1000 / (200 * 10)

= 0.5 lot (or 5 mini lots)

For this trade, if the market moves 500 pips in your favor, you’ll gain $2500.

Naturally, it’ll be obvious as you use a forex risk management calculator, but the bottom line is this…

A tighter stop loss allows you to put on a larger position size — for the same level of risk.

So, how do you apply this concept to your trading?

By being patient and letting the market come to your level.

Here’s what I mean:

Both A & B have the same stop loss.

The only difference is where you’re shorting the market — and this makes a huge difference to your bottom line.

So, do you want to short A or B?

This is one of the most common questions I get from traders…

“Hey, Rayner, how much leverage do you use?”

If you are unfamiliar with the term leverage, it means how many times larger you can trade relative to your account size.

So, if you have 1:100 leverage and your account size is $1000; this means you can trade up to $100,000 worth of the underlying instrument (like stocks, currencies, futures).

But here’s the truth:

I don’t bother about leverage. Why?

Because it has zero relevance to your risk management.

So, how many units can you trade?

Position size = 1000 / (50 * 10)

This represents $200,000 worth of EUR/USD, or in other words, a leverage of 1:2.

What if your stop loss is 500 pips?

Again, apply the position sizing formula and you get…

This represents $20,000 worth of EUR/USD, or in other words, a leverage of 1:0.2.

Do you see my point?

In both scenarios, the maximum loss on each trade is $1000, even though you’re using different leverages. Why?

Because the leverage you use depends on the size of your stop loss. The smaller your stop loss, the more leverage you can use while keeping your risk constant. And the larger your stop loss, the less leverage you can use while keeping your risk constant.

Don’t bother too much about leverage, especially when it comes to knowing how to calculate risk management forex because it is largely irrelevant unless you don’t have a risk management and a stop loss method altogether.

Instead, focus on how much you can lose per trade, and adopt the correct position size for it.

#1: Did you always start with a 1% risk per trade?

In the beginning, I didn’t risk 1% per trade, I was risking about 2-3% per trade because my account back then was much smaller. But as my account grew over time, my current risk on each trade is not more than 1%.

So, when I use a forex risk management calculator, I make sure that I don’t lose more than 1% of my capital per trade.

#2: In your example, if you’re long 100,000 units of EUR/USD, the value per pip is US$10. How did you derive that $10/pip?

This is a commonly used value set by most Forex brokers, where they’ll use US$10/pip for each lot that you’re trading.

#3: Can I use a fixed lot size for each trade to keep the trades simple?

Yes, you can. But bear in mind, that since the value per pip and volatility for each instrument are different, the size of your stop loss would also likely differ for each trade as well. So it affects your risk on each trade in dollar amount.

I hope by now you realized that forex risk management is KING. Without it, even the best trading strategy will not make you a consistently profitable trader.

Next, you’ve learned that forex risk management and position sizing are two sides of the same coin. With the correct position sizing, you can trade across any markets and still manage your risk.

This is the position sizing formula that lets you achieve it, so that you can also create your own forex lot size calculator:

The amount you’re risking / (stop loss * value per pip)

Then, you’ve learned how to find low risk and high reward trades. The secret is entering your trades near Support and Resistance. Because you can have a tighter stop loss, which lets you put on a larger position size — and still keep your risk constant.

Lastly, I explained why leverage is irrelevant because it doesn’t help you manage your risk. The only thing that matters is proper position sizing that lets you risk a fraction of your trading capital.

How do you apply forex risk management to your trading?

Leave a comment below and let me know your thoughts.